Holdings, the innovative profit platform designed for small businesses, nonprofits, and independent professionals, has unveiled its comprehensive Profit Bundle—a unified solution that integrates always-free business banking, a flat 2% APY on all qualifying balances, integrated accounting, and complete bookkeeping services. To commemorate this launch, Holdings is providing three months of complimentary accounting or bookkeeping services for both new and existing customers, which includes an additional free month for those needing to catch up.

“Business leaders and nonprofit administrators deserve a financial ally that rewards their dedication rather than penalizing it,” stated Jason Garcia, Founder & CEO of Holdings. “We created Holdings to simplify money management in a way that is both straightforward and beneficial, allowing organizations to concentrate on what truly matters—growth, impact, and their core mission.”

Notable features of the Holdings Profit Bundle encompass:

No-fee banking: No monthly, overdraft, or transaction fees—ever. No minimum balances or hidden costs.

Flat 2% APY on all balances: Increase earnings on every dollar, with no caps or special conditions.

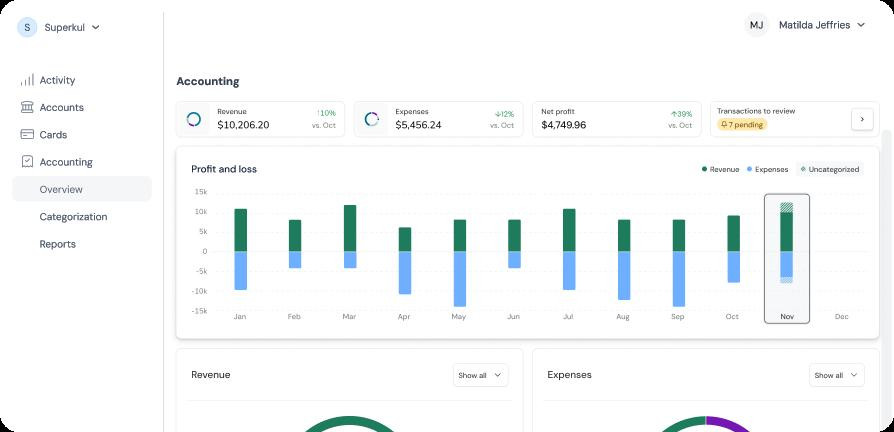

Integrated accounting: $20/month following a 3-month complimentary trial, featuring advanced automation and AI-driven categorization.

Comprehensive bookkeeping: Starting at $100/month after a 3-month free trial, including a complimentary month of catch-up to assist organizations in getting current.

Unlimited sub-accounts: Easily allocate funds for budgeting, grant tracking, or managing restricted/unrestricted cash—perfect for nonprofits and startups.

Cash deposits: Free at over 55,000 Allpoint® ATMs across the country.

Tailored funding options: Access personalized loan proposals based on actual business performance—eliminating the need to chase lenders or depend solely on credit scores.

Extensive integrations: Seamless sync with QuickBooks and Xero, connectivity with the Stripe network, and built-in accounting and bookkeeping capabilities.

$3 million FDIC insurance: Through Holdings’ sweep network, funds are safeguarded up to $3 million—12 times the standard coverage.

Holdings is accessible nationwide to all types of business entities, including sole proprietors, LLCs, corporations, nonprofits, and trusts. The platform is engineered to assist organizations in saving time, optimizing their financial resources, and gaining access to smarter financing—all within a single platform.

Launch Offer:

In celebration of this launch, Holdings is offering three months of complimentary accounting or bookkeeping services (including a free month of catch-up for organizations needing to get current)—risk-free, with no obligation.

Learn more.