Holdings, the innovative profit platform designed for small businesses, nonprofits, and self-employed individuals, has officially unveiled its comprehensive Profit Bundle—a streamlined solution that merges always-free business banking, a consistent 2% APY on all eligible balances, integrated accounting, and complete bookkeeping services. In celebration of this launch, Holdings is providing new and returning clients with three months of complimentary accounting or bookkeeping services, which includes an additional month for organizations that require assistance in catching up.

“Business proprietors and nonprofit executives deserve a financial ally that acknowledges their efforts rather than penalizing them,” stated Jason Garcia, Founder & CEO of Holdings. “We created Holdings to transform money management into a straightforward and rewarding experience, allowing organizations to concentrate on what truly matters—growth, impact, and their core mission.”

Notable features of the Holdings Profit Bundle include:

No-fee banking: Experience zero monthly, overdraft, or transaction fees—ever. No minimum balance required, and no hidden costs.

Consistent 2% APY on all balances: Maximize earnings on every dollar, without caps or special conditions.

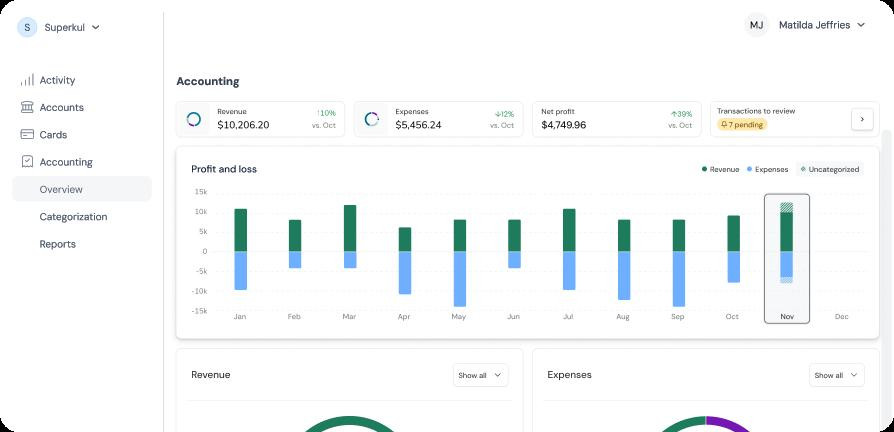

Integrated accounting: Available for $20/month following a 3-month free trial, featuring advanced automation and AI-driven categorization.

Comprehensive bookkeeping services: Starting at $100/month after a 3-month complimentary trial, including a free month of catch-up for organizations needing to update their records.

Unlimited sub-accounts: Easily allocate funds for budgeting, grant monitoring, or managing restricted/unrestricted cash—perfect for nonprofits and startups.

Cash deposits: Available at over 55,000 Allpoint® ATMs across the nation at no charge.

Proactive funding solutions: Access customized loan options based on actual business performance—eliminating the need to chase lenders or rely solely on credit ratings.

Extensive integrations: Seamless syncing with QuickBooks and Xero, Stripe network connectivity, and built-in accounting and bookkeeping capabilities.

$3 million FDIC insurance: Through Holdings’ sweep network, funds are safeguarded up to $3 million—12 times the standard coverage limit.

Holdings is accessible across the nation for all types of business entities, including sole proprietorships, LLCs, corporations, nonprofits, and trusts. The platform is engineered to assist organizations in saving time, optimizing every dollar, and obtaining smarter financing solutions—all within a single platform.

Launch Offer:

To commemorate this launch, Holdings is providing three months of free accounting or bookkeeping services (including a complimentary month of catch-up for organizations needing to update their records)—risk-free, with no obligations.

Learn more.